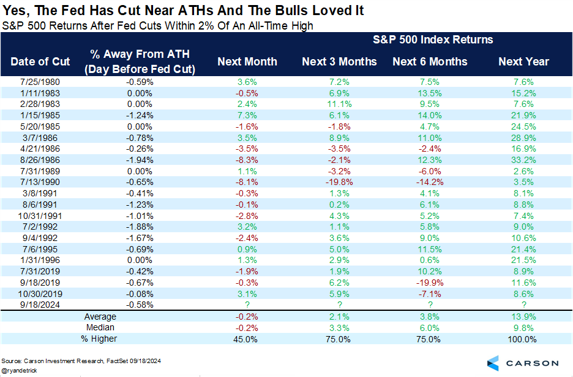

Closer Look: When the Fed Cuts at All-Time Highs

See important disclosures below.When a rate cutting cycle begins with equities near record levels, many investors ask if the rally is out over its skis. But history points in a different direction. Since 1980, there have been multiple episodes when the Federal Reserve eased policy while the S&P 500 stood within about 2% of an all time high. Carson Group’s research tallies 20 such instances and finds the index was higher one year later every time, with the average gain close to the mid-teens. Of course, that is not a guarantee of future returns. It is a useful base rate that reframes the instinct to sell simply because prices are at peaks.Not all cuts carry the same message. The worst equity outcomes tend to follow rapid cuts into a clear recession, when earnings are contracting and the policy impulse is attempting to cushion a downturn. Cuts that arrive as inflation cools and growth stabilizes often look different. Financial conditions ease, earnings trajectories stay serviceable, and multiples can hold or expand. That is why several prior cycles saw continued equity strength after the first move, even with short bursts of volatility around the announcement. The key is context. If labor markets and demand are not unraveling, an initial cut has historically extended rather than ended bull advances.Advisors may find the chart above helpful in client conversations because it quantifies a pattern that feels counterintuitive. New highs are common in durable advances. They are markers of strength, not expiration dates. Carson’s work looks back to 1980 and isolates instances when the Fed cut with the S&P 500 within roughly 2% of a record. One year later, the index was positive in 20 out of 20 cases, with an average return near 14%. The short-term path was not always smooth, but the one-year outcome was consistently constructive. That makes the chart a useful behavioral anchor when headlines conflate a cut with a top.Expect a choppier path even if the twelve-month backdrop is favorable. The market frequently digests the rate decision with a bout of two-way trading as investors parse the pace and rationale for cuts against what was already priced. Rather than anticipate the chop with timing trades, build room for it in the plan. Use rebalancing bands, tax aware buying on weakness, and cash buffers where appropriate for client specific needs.The broader lesson for advisors is that history provides perspective but not precision. Each cycle carries unique conditions, whether inflation dynamics, global demand, or fiscal policy overlays. What repeats is the tendency for investors to overestimate the immediate risks of policy shifts and underestimate the longer-term power of staying invested. Using historical analogs like the research above can help reframe client concerns and reinforce that new highs coupled with rate cuts have often been part of extended advances, not abrupt endings.Lately, markets have been reacting to every Fed headline. Long-term outcomes are driven more by asset allocation, time in the market, and systematic rebalancing versus ad-hoc timing decisions. At Ategenos, we aim to make our guidance as straightforward as possible: align portfolios with a well-constructed financial plan, diversify across complementary sources of return, and remain invested through the noise. Staying disciplined rather than reactionary has historically been the most reliable way to compound wealth across full cycles.Like this update? Sign up for our Daily Market Update.

This report and the opinions provided herein are for informational purposes only, are not a solicitation, and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security or investment. All opinions expressed herein constitute the author’s judgement as of the date of this document and are subject to change without notice. Statements made are not facts, including statements regarding trends, market conditions and the experience or expertise of author are based on current expectations, estimates, opinions and/or beliefs. Such statements are not facts and involve known and unknown risks, uncertainties and other factors. Past events and trends do not predict or guarantee or indicate future events or results. Information cited in this report has been drawn from sources believed to be reliable and was captured at a point in time. Therefore, the data is subject to change and its accuracy is not guaranteed. DJIA, S&P, Russell 2000, and NASDAQ indices are referenced directly; MSCI EAFE, MSCI EM, BB U.S. Aggregate, Bloomberg U.S. Corp. HY, and all sector figures refer to the respective ETFs as a representative figure. Ategenos does not own or control and is not affiliated with any third-party content provided via hyperlink, quoted, or cited herein. Investors seeking more information should contact their financial advisor. Investing involves risk, including the possible loss of principal. It is not possible to invest directly in an index. Past performance does not guarantee future results. Ategenos is an investment adviser registered with the SEC. SEC registration does not imply any specific level of training or skill.