Closer Look: Building an Alternatives Portfolio - A Puzzle, Not a Plug-In

See important disclosures below.In recent years, financial advisors and HNW investors have grown increasingly interested in alternative investments (private equity, private credit, real estate, infrastructure, etc.) as tools to complement traditional portfolios composed of stocks, bonds, ETFs, and mutual funds. This shift reflects a broader desire for diversification, downside protection, and the potential for enhanced risk-adjusted returns. But constructing an effective alternatives allocation is not a simple plug-and-play solution. Instead, it’s more akin to solving a puzzle, requiring thoughtful consideration of return objectives, liquidity constraints, risk tolerance, and investment horizon.Unlike traditional assets that trade on public exchanges and are priced daily, alternatives are typically less liquid and more opaque. Private equity, for instance, offers access to companies before they go public or are acquired, with the potential for outsized returns through operational improvements or strategic exits. However, these investments are generally accompanied by long lock-up periods (7 to 10+ years) and significant capital commitment requirements. This lack of liquidity must be accounted for at the portfolio level to ensure the investor can meet shorter-term cash flow needs.Private credit has gained prominence as an alternative to traditional fixed income, particularly in today’s higher interest rate environment. It often involves lending directly to middle-market companies, with investors receiving yields that can outpace publicly traded bonds due to the illiquidity premium and underwriting complexity. However, this comes with heightened risk. Credit quality varies widely, and these loans can be more susceptible to defaults during economic downturns. Assessing whether private credit replaces a portion of traditional fixed income or serves a unique role in a portfolio depends on the investor’s risk budget and return goals.Real estate and infrastructure, meanwhile, offer different benefits and risks. Private real estate investments, whether through funds, REIT alternatives, or direct ownership, can provide income through rents and appreciation through property value growth. Infrastructure investments, such as toll roads, airports, or utility assets, tend to deliver steady cash flows and can serve as a potential hedge against inflation. Both asset classes offer diversification benefits due to their relatively low correlation with equities and bonds, but they also come with illiquidity and longer investment horizons, typically 5 to 10+ years.According to a 2024 survey by Preqin, institutional investors allocate, on average, nearly 20% of their portfolios to alternatives, which is up from just 15% in 2019. While individual investors are still playing catch-up, new access vehicles like interval funds, tender offer funds, and feeder structures are enabling greater inclusion at lower minimums. This democratization opens the door for broader use in private wealth portfolios but also introduces new challenges in portfolio construction.Simply allocating a fixed percentage (e.g. 20%) to alternatives is rarely the most optimal approach. Unlike adding a new mutual fund to a 60/40 portfolio, building an alternatives allocation requires mapping each investment’s unique liquidity profile, drawdown schedule, expected return distribution, and potential capital call obligations. For example, an investor with a heavy allocation to private equity may find that layering in private real estate could over-concentrate illiquid exposure. Similarly, adding private credit may increase yield but at the cost of compounding default risk if market conditions deteriorate.Advisors must also help clients understand the behavioral implications of illiquidity. Private investments do not offer daily pricing, which can reduce emotional decision-making tied to volatility. This also means less visibility and more uncertainty during periods of market stress. Education around time horizon and portfolio role becomes critical to avoid panic-driven decisions or misaligned expectations.In summary, building a complementary alternatives portfolio is a dynamic and nuanced process. It requires an architectural mindset: balancing cash flows, managing liquidity, diversifying risks, and sequencing capital commitments. However, when executed thoughtfully, the result is not merely diversification for its own sake but a more resilient portfolio designed to perform across cycles and reduce reliance on the binary outcomes of public markets. Like any good puzzle, it’s not about how many pieces you have. It’s about how well they fit together. And as part of the Ategenos Private Wealth solution, our Portfolio Managers help to formulate the appropriate mix of assets for each HNW client.Like this update? Sign up for our Daily Market Update.

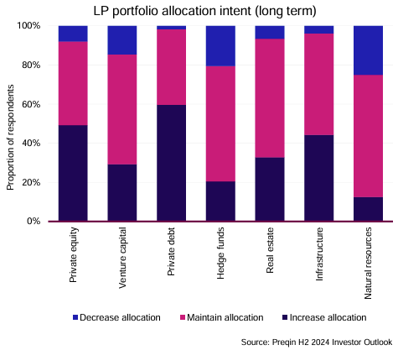

This report and the opinions provided herein are for informational purposes only, are not a solicitation, and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security or investment. All opinions expressed herein constitute the author’s judgement as of the date of this document and are subject to change without notice. Statements made are not facts, including statements regarding trends, market conditions and the experience or expertise of author are based on current expectations, estimates, opinions and/or beliefs. Such statements are not facts and involve known and unknown risks, uncertainties and other factors. Past events and trends do not predict or guarantee or indicate future events or results. Information cited in this report has been drawn from sources believed to be reliable and was captured at a point in time. Therefore, the data is subject to change and its accuracy is not guaranteed. DJIA, S&P, Russell 2000, and NASDAQ indices are referenced directly; MSCI EAFE, MSCI EM, BB U.S. Aggregate, Bloomberg U.S. Corp. HY, and all sector figures refer to the respective ETFs as a representative figure. Ategenos does not own or control and is not affiliated with any third-party content provided via hyperlink, quoted, or cited herein. Investors seeking more information should contact their financial advisor. Investing involves risk, including the possible loss of principal. It is not possible to invest directly in an index. Past performance does not guarantee future results. Ategenos is an investment adviser registered with the SEC. SEC registration does not imply any specific level of training or skill.